CA Intermediate Crack the exam on your 1st attempt

Book A Free Trial Class

CA Intermediate | ||

S.No. | Subjects | Weightage |

Group I | ||

| 1 | Advanced Accounting | 100 |

| 2 | Corporate & Other Laws | |

| a) Company Law & Limited Liability Partnership Law | 70 | |

| b) Other Laws | 30 | |

| 3 | Taxation | |

| a) Income Tax Law | 50 | |

| b) Goods & Services Tax | 50 | |

Total | 300 | |

Group II | ||

| 4 | Cost & Management Accounting | 100 |

| 5 | Auditing & Ethics | 100 |

| 6 | Financial Management & Strategic Management | |

| a) Financial Management | 50 | |

| b) Strategic Management | 50 | |

Total | 300 | |

Batch - Online | Offline

Avail 50% Scholarship

March 2025

- Induction – August Last week

- Classes – September 1st week

- Last date to register – August 28th, 2024

- Scholarship test- till February upto 50% scholarship

Easy and Fun Learning Experience

Are you ready to take the next big step in your accounting career? We invite all aspiring Chartered Accountants in the making to be part of our exclusive CA (Intermediate) Batch. This is your opportunity to unlock your full potential and pave the way for a thriving future in the world of finance and accounting.

Comprehensive Curriculum

Our meticulously designed curriculum covers all essential subjects and concepts required to excel in the Intermediate level CA exams.

Practical Insights

Gain real-world insights into accounting, taxation, auditing, and more, preparing you for the challenges of the professional world.

Experienced Faculty

Learn from the best in the field. Our experienced faculty members are dedicated to providing you with top-notch guidance and support throughout your journey.

Flexible Schedule

We understand the demands of your busy life. Our flexible class schedules allow you to balance your studies with other commitments.

Need Help?

FAQ - CA Intermediate

Commonly students ask these questions, kindly look into this to sort it out.

For more queries, feel free to contact us

What is the eligibility criteria for registering in Intermediate course?

| 1. Graduates/Post Graduates in Commerce ( with minimum 55% marks ) |

| 2. Graduates/Post Graduates othre than Commerce ( with minimum 60% marks ) |

| 3. CS/CMA Intermediate qualified |

| 4. CA Foudnation qualified |

What will be the syllabus & Examination pattern of CA Intermediate?

| There are 6 papers in CA Intermediate Course. There will be case scenario/case study based MCQs and 70% descriptive questions in all the papers. |

| Group I |

| 1. Advanced Accounting ( 100 marks ) |

| 2. Corporate & Other Laws |

| a) Company Law & Limited Liability Partnership Law (70 marks ) |

| b) Other Laws ( 30 marks ) |

| 3. Taxation |

| a) Income Tax Law ( 50 marks ) |

| b) Goods & Services Tax ( 50 marks ) |

| Group II |

| 4. Cost & Management Accounting ( 100 marks ) |

| 5. Auditing & Ethics ( 100 marks ) |

| 6. Financial Management & Strategic Management |

| a) Financial Management (50 marks) |

| b) Strategic Management ( 50 marks ) |

What is the passing criteria for CA Intermediate?

| 1. Both Groups |

| A student should get a minimum of 50% marks in the aggregate of all the papers along with minimum of 40% marks in each paper. |

| 2. Single Group |

| A student should get a minimum of 50% marks in the aggregate in each Group along with minimum of 40% marks in each paper. |

Only The Best Tutors

Here at Learncrew we handpick only the best qualified, expert, and friendly tutors for you.

Specializing in specific subjects for your CA(Foundation) & CA(Intermediate).

Vasanth

Accountancy, Costing

Samuel Sundar, CA

Economics, Taxation

Rajkumar, CA

Business Law, Financial Management

Lakshmanan

Maths & Logical

Don’t just take our word for it

“Padma has been a great help to us during the last year of distance learning. My daughter managed to fill the gap in her class and was able to crack CA Foundation. Me and my husband are very thankful for Padma's dedication to help our Priya succeed.“

Rohini S

“I was fortunate to have Lakshmanan Sir as my tutor. He is extremely patient, professional and knowledgeable and helped me to increase my confidence to crack the MBA entrance exam. Without a doubt, I can credit Learncrew for my achievements!”

Prasad. T

“Learncrew have helped me enormously through my CA Foundation preparation. They provided me tutors, expert in their field. Vasanth Sir and Sam Sir helped me grasp difficult concepts in accountancy and tax easily and ensure that I excel. I would definitely recommend!”

Aditya. J

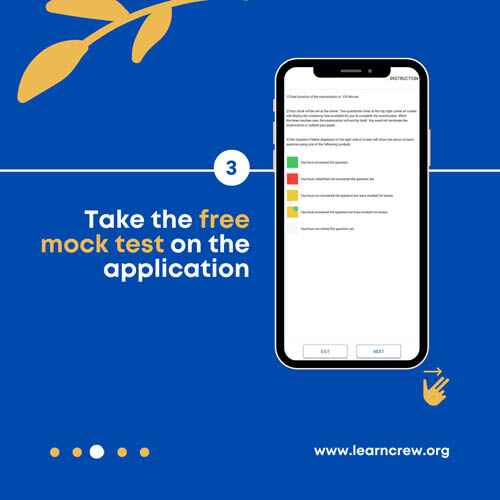

One stop exam preparation

Our app provides you the daily current affairs, mock test papers for almost any management, law, banking or any government exam.