CA Foundation 2024

Here you are at the 1st step to your journey to success for CA foundation 2024, at LearnCrew!! Chartered accountant, it’s just not a word, it’s an emotion for millions of people in India, just imagine yourselves after 4.5 to 5 years completing the course and being called as “Chartered Accountant” it’s a good feeling right, with tears of joy rolling out from your family, friends, and well-wishers!! Again, to remind you guys, CA is a not a degree but an emotion.

“Let’s create basic awareness of the CA foundation 2024 programme: “

CA foundation 2024 Eligibility

To appear for CA foundation 2024 exam, you need to fulfil the below criteria – eligibility metrics –

- Candidates must get registered with the ICAI prior to 4 months from the scheduled exam date – example – for CA Foundation 2024 June registration closes by Feb 1st, 2024 (or)

- Candidate is converted from CPT to CA Foundation as on the date of filling the exam form (and)

a. Candidates must have passed 10+2 board exams from a recognised board and his/her mark sheets must be uploaded in the official ICAI portal – called as SSP portal (or)

b. Appeared in 10+2 board exam from recognised board and his/her class board admit card must be uploaded in the SSP portal.

- Should have Valid login credentials on SSP Portal (students who are first time users, must register themselves on the portal just like how you register on any Social media platform)

- Students to have valid course registration, in case it is lapsed, request to please validate with the ICAI institute.

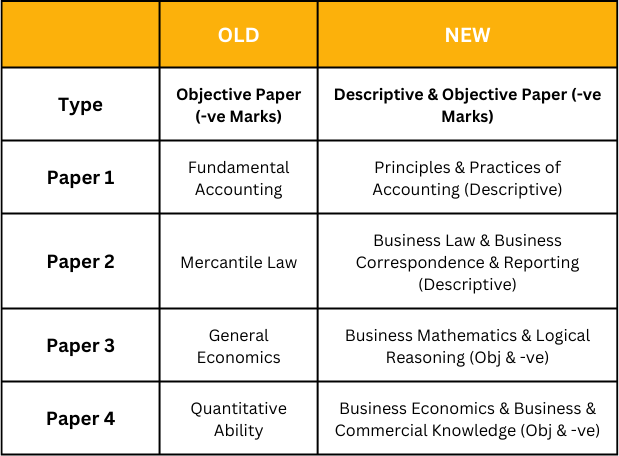

CA Foundation 2024 Comparision Old vs New

CA Foundation 2024 Syllabus

- Paper 1: Principles and Practice of Accounting

- Theoretical Framework

- Accounting Process

- Bank Reconciliation Statement

- Inventories

- Concept and Accounting of Depreciation

- Accounting for Special Transactions

- Final Accounts of Sole Proprietors

- Partnership Accounts

- Paper 2: Business Laws & Business Correspondence and Reporting

- Section A: Business Laws

- Indian Contract Act, 1872

- Sale of Goods Act, 1930

- Indian Partnership Act, 1932

- Section B: Business Correspondence and Reporting

- Communication

- Sentence Types and Word Power

- Vocabulary Root Words, Synonyms, Antonyms, Prefixes, Suffixes, Phrasal verbs, Collocations, Idioms, and Proverbs

- Comprehension Passages and Note-Making

- Developing Writing Skills

- Section A: Business Laws

- Paper 3: Business Mathematics and Logical Reasoning & Statistics

- Part I: Business Mathematics and Logical Reasoning

- Ratio and Proportion, Indices, and Logarithms

- Equations and Matrices

- Linear Inequalities with Objective Functions and Optimization

- Time Value of Money

- Permutations and Combinations

- Sequence and Series

- Sets, Relations, and Functions

- Part II: Statistics

- Statistical Description of Data

- Measures of Central Tendency and Dispersion

- Probability

- Theoretical Distributions

- Correlation and Regression

- Index Numbers and Time Series

- Part I: Business Mathematics and Logical Reasoning

- Paper 4: Business Economics and Business and Commercial Knowledge

- Part I: Business Economics

- Introduction to Micro Economics

- Theory of Demand and Supply

- Theory of Production and Cost

- Price Determination in Different Markets

- Part II: Business and Commercial Knowledge

- Business and Commercial Knowledge

- Part I: Business Economics

How to prepare?

There are multiple methods to prepare for the entrance exam.

- Self Study – From Youtube and online media

- Offline proctored classes – Recognised institutes

- Online proctored classes – Recognised Institutes

- Practicing old papers

Apart from preparing for exam, next important aspect is to attempt mocks, as many as possible. Having a routine and following it strictly.

Conversion: Candidate registered under Old Scheme compulsorily must convert on Self Service Portal from CPT to CA Foundation.

- Photograph and Signatures to be updated – Latest documents to be uploaded.

- For any other queries, request to email to the service helpdesk at the SSP portal.

Apart from this, once registration is done – examination fees to be paid – ideally prior 2 months the portal will open for registration and once done, the admit cards will be received on registered email ID.

The exams will be conducted twice a year – in the months of June and December.

And results will be published after 2 months from the date of examination.

Once the above is done, you are officially called a CA student!! To be part of the ICAI fraternity in the future, become a member and be officially called as a chartered accountant, join us in the journey to success at LearnCrew.