Kickstart Your CA Career: Master the CA Foundation with Expert Coaching!

Unlock the ways to handle the tedious process of Accounting, Business Law, Quantitative aptitude & Economics in the smartest way possible under the guidance of the people who have cracked the code and are practicing Chartered Accountants.

Upto 90% scholarships for students who Secured above 95% in their 12th

8 Months

Offline & Online

Mon, Tue, Wed, Thu, Fri

4:30 to 8:30PM IST(4 hour)

Get trained from the “Best!”

Reserve your seat before 10th of every month for additional scholarships upto 20%.

Reserve your seat before 10th of every month for additional scholarships upto 20%.

8 Months

Offline & Online

Mon, Tue, Wed, Thu, Fri

4:30 to 8:30PM IST(4 hour)

Get trained from the “Best!”

15 out of 20 have cleared CA foundation in 2024

Select all the boxes where your answers are YES!

- I do not know how to prepare for CA

- What skills should I learn additionally?

- Should I write Entrance exam for CA?

- Will it help me in placements?

- Is CA Foundation difficult to crack

- Is CA really worth doing in 2024?

- I am not sure which Specialization to choose

- What kind of Job roles can i choose?

If you have selected “Any” boxes, then join this course to learn everything about CA Foundation and the techniques to crack it with “Ease”. If you don’t trust me, just look at the kind of results students have secured & their feedbacks.

How it works

What is CA Foundation?

Chartered Accountancy (CA) is a prestigious professional qualification in accounting and finance. Chartered Accountants are responsible for auditing, taxation, financial reporting, and business advisory services.

- Completed 12th or Equivalent

Thrice a year

January | June | September

Exam Modes

PBT(Paper), OMR Sheets

Scoring

400 marks | 0.25 -ve

Learncrew's MOU for CA Foundation & CAT

Still wondering if you should choose to do this course?

CA is a whole New World, where business entities rely on their valuable inputs to take an informed decision. Up next, You could be one of these below !

Next Fintech Founder

Venture Capitalist

Next Finance Analyst

What will you learn over 8 months in this course?

Paper-1: Accounting

Module 1:

- Theoretical Framework

- Accounting Process

- Bank Reconciliation Statement

- Inventories

- Depreciation and Amortisation

- Bills of Exchange and Promissory Notes

- Preparation of Final Accounts of Sole Proprietors

Paper-1: Accounting

- Financial Statements of Not-for-Profit Organisations

- Accounts from Incomplete Records

- Partnership and LLP Accounts

- Company Accounts

Paper-2: Business Laws

- Indian Regulatory Framework

- The Indian Contract Act, 1872

- The Sale of Goods Act, 1930

- The Indian Partnership Act, 1932

- The Limited Liability Partnership Act, 2008

- The Companies Act, 2013

- The Negotiable Instruments Act, 1881

Paper-4: Business Economics

- Nature & Scope of Business Economics

- Theory of Demand and Supply

- Theory of Production and Cost

- Price Determination in Different Markets

- Business Cycles

- Determination of National Income

- Public Finance

- Money Market

- International Trade

- Indian Economy

Paper-3: Quantitative

PART-A: BUSINESS MATHEMATICS

- Ratio and Proportion, Indices, Logarithms

- Equations

- Linear Inequalities

- Mathematics of Finance

- Basic Concepts of Permutations and Combinations

- Sequence and Series – Arithmetic and Geometric Progressions

- Sets, Relations and Functions, Basics of Limits and Continuity functions

- Basic Applications of Differential and Integral Calculus in Business and Economics

Paper-3: Quantitative

- Number Series, Coding and Decoding and Odd Man Out

- Direction Tests

- Seating Arrangements

- Blood Relations

- Basics

- Measures of Central Tendency and Dispersion

- Probability

- Theoretical Distributions

- Correlation and Regression

- Index Numbers

Register yourself before midnight of 10th of every month

To avail additional discounts & bonuses

🕑 Time is running out!

How to start the Journey?

Step 1

Enrol yourself in the course for CA Foundation exam preparation. Start if you have completed your 11th or in your degree.

Step 2

Get access to the Live and Recorded classes. You will be added to a common group and you will have information on the schedule.

Step 3

Start 15 days basic preparation for your Speed Math & Simplification. Install any Number game and play for an hour everyday.

Step 4

Once you complete 50% of your syllabus, start with your Mocks and rectify the mistakes you have committed and reattempt it.

Step 5

Once Entire syllabus is completed, start your revision with which section you find it difficult, and reattempt sectional mocks based on that.

Meet your mentor !

Hi, My name is Lakshmanan Annamalai

Being an Engineer, Mathematics has been my passion and I love to solve and teach students the simple methods to solve problems. I have trained students to crack their competitive exams in a short span of time.

Now what are you waiting for? I’ll help you crack the entrance exam with ease. Just follow the methodology we insist and reap from the benefits.

Vasanth

Accountancy, Costing

Samuel Sundar, CA

Economics, Taxation

Rajkumar, CA

Business Law

FAQ - CA Foundation

Commonly students ask these questions, kindly look into this to sort it out.

For more queries, feel free to contact us

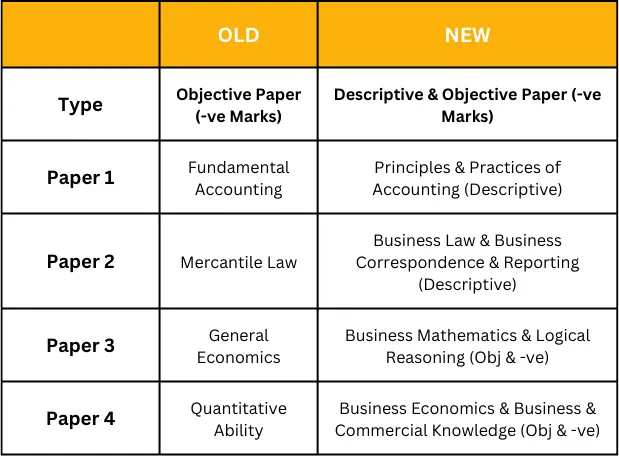

What is the Structure of CA Course under the New Scheme ?

| Chartered Accountancy course has total three levels |

| a) CA Foundation |

| b) CA Intermediate |

| c) CA Final |

What is the validity period of Students registration in each course ?

| The validity period of Student’s registration in each course is for 4 years from the date of registration |

Is there any negative marking in CA Foundation Course ?

| Yes, there is negative marking of 0.25 mark for every wrong answer in objective type paper. |

I have already registered in CA Foundation Course after passing Class 10th Examination and presently I am in Class 11. When I will be eligible for CA Foundation Examination under New Scheme?

| Your first attempt will be immediately after appearing in Class 12th Examination conducted by the recognized board. |

What are the papers in CA Foundation Course?

| There are four papers in CA Foundation Course |

| 1. Accounting ( 100 marks ) |

| 2. Business Laws (100 marks ) |

| 3. Quantitative Aptitude |

| a) Business Mathematics ( 40 marks ) |

| b) Logical Reasoning ( 20 marks ) |

| c) Statistics ( 40 marks ) |

| 4. Business Economics ( 100 marks ) |

What is the passing criteria for CA Foundation

A student should get a minimum of 50% marks in the aggregate of all the papers along with minimum of 40% marks in each paper

One-Stop Exam Preparation!

Download our app for daily current affairs updates, mock test papers, and comprehensive exam preparation material for management, law, banking, and government exams. Ready to embark on your CLAT journey? Get in touch for a FREE DEMO session today!

Don’t just take our word for it

“Padma has been a great help to us during the last year of distance learning. My daughter managed to fill the gap in her class and was able to crack CA Foundation. Me and my husband are very thankful for Padma's dedication to help our Priya succeed.“

Rohini S

“I was fortunate to have Lakshmanan Sir as my tutor. He is extremely patient, professional and knowledgeable and helped me to increase my confidence to crack the MBA entrance exam. Without a doubt, I can credit Learncrew for my achievements!”

Prasad. T

“Learncrew have helped me enormously through my CA Foundation preparation. They provided me tutors, expert in their field. Vasanth Sir and Sam Sir helped me grasp difficult concepts in accountancy and tax easily and ensure that I excel. I would definitely recommend!”

Aditya. J

Still not Convinced ?

Attend a demo or watch the demo.

Being confused is alright, get yourself completely clear of what you are going to learn and how is it going to be. Take the best decision to make your future secured and be in the right hands.

Provide your details below to get a free demo class and a demo video on your given Mail ID.